Self Credit Builder Account Review 2024

Self Credit Builder

Product Name: Self Credit Builder

Product Description: The Self Credit Builder Account is a personal loan that builds both credit and your savings at the same time.

Summary

The Self Credit Builder Account is a loan that, instead of receiving the funds from the loan, they are put into a CD to be released to you when the loan is paid off. You make payments for 24 months and at the end you receive the funds from the CD, minus interest and fees from the loan. This builds credit and savings simultaneously.

Pros

- No credit check.

- Your credit history will be reported to all three major credit bureaus.

- Build savings and your credit at the same time.

- Free monthly credit score.

- There is no minimum income requirement.

- Self offers a $10 referral bonus for family and friends you refer.

Cons

- You can have only one active Credit Builder Account at any one time.

- The Self Secured Visa® Credit Card credit line is tied to the balance in your Credit Builder Account.

- There is a small early withdrawal penalty if you pull out of the program early.

If you have bad credit or no credit, then you know how hard it can be to increase your credit score. But luckily, there’s a financial service that will help you to either build or rebuild your credit.

The Self Credit Builder Account is a loan that you can use to build your credit and your savings. When you take a loan, instead of receiving the money from the loan, it is put into a CD. You make payments on the loan, and when the loan is paid off, you’ll receive access to the funds in the CD minus the loan interest and fees.

Your payments are reported to the credit bureaus, and at the end you have some money in savings.

At a Glance

- Builds credit and savings at the same time

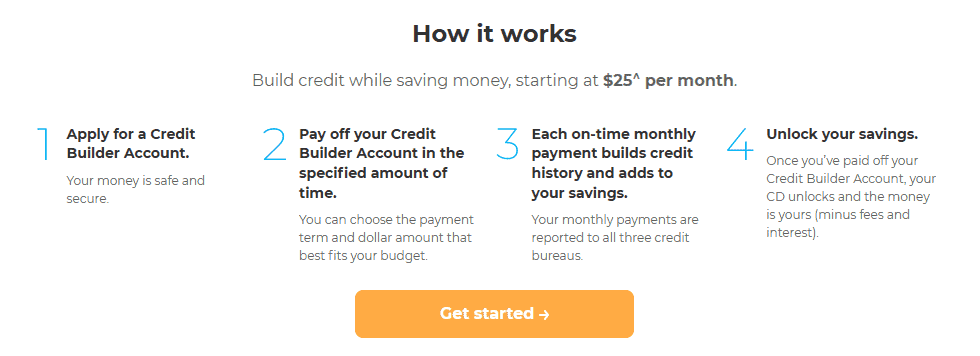

- Four plans available, with payments starting at $25 per month

- No hard credit check

- A credit card that is secured by the CD is also available

Who Should Use a Self Credit Builder Account?

Self is best for those who need to rebuild their credit but do not want to put down a security deposit for a secured card. It offers a legitimate and inexpensive way to simultaneously build credit and savings.

There are no income limits or hard credit check, but you do need to provide your social security number. You also need to be at least 18 years old and have a bank account. You’ll also want to choose a payment plan that fits easily into your budget. Plans are between $25 and $150 a month.

Self Credit Builder Alternatives

|

|

||

| Builds savings | |||

| Builds credit with everyday bills | Yes | Yes | Yes |

| Pricing | $5 per month | Free | $4.99 to $29.99 per month |

| Learn more | Learn more | Learn more |

Table of Contents

- At a Glance

- Who Should Use a Self Credit Builder Account?

- Self Credit Builder Alternatives

- What is the Self Credit Builder Account?

- How a Self Credit Builder Account Works

- Self Credit Builder Account Loan Options

- How to Open a Self Credit Builder Account

- Self Visa® Credit Card

- Why Not Just Apply for a Credit Card or a Personal Loan?

- Self Credit Builder Account Features

- Self Credit Builder Account Pricing & Fees

- Self Credit Builder Account Pricing & Fees

- Alternatives to Self Credit Builder

- Will Self Credit Builder Work for You?

What is the Self Credit Builder Account?

Based in Austin, Texas, and founded in 2014, the company’s official name is Self Financial, Inc.; however, it is commonly known simply as Self. The company is dedicated to giving its customers the ability to either better their credit or to build it from the ground up. The company reports that more than 500,000 consumers have used the service.

Self is a technology company offering their Credit Builder Account to those who either have no credit or don’t have access to traditional financial products. The account is an installment loan that enables customers to build a positive payment history, while also saving money.

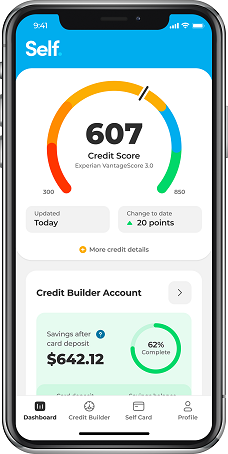

Self Financial has a Better Business Bureau rating of “B”, on a scale of A+ to F. It also has a rating of 4.8 stars out of five by nearly 16,000 users on Google Play, and 4.9 out of five stars among more than 39,000 users on The App Store.

How a Self Credit Builder Account Works

As described above, Self offers their Credit Builder Account, which is a loan that runs for a term of 24 months. You can choose the repayment plan that fits your budget. And each time you make a monthly payment, it will be reported all three major credit bureaus – Experian, Equifax, and TransUnion. Whether you have no credit or poor credit, making your payments on time each month will help you to either build or better your credit history.

There’s an added bonus to the arrangement, and it’s huge. Each time you make a monthly payment, you’ll be adding funds to a certificate of deposit (CD) in your name, which acts as security for the loan.

You’ll start the process by applying for a loan that will be held with one of Self’s bank partners. Bank partners include Sunrise Bank, Lead Bank, and First Century Bank. The same bank will also accumulate the monthly contribution to the CD portion of your payments.

Self Credit Builder Account Loan Options

Self offers four different loan options, each with 24-month terms. The details of each are as follows:

| Monthly Payment | APR | Total Payments | CD Balance at End of Term |

|---|---|---|---|

| $25 | 15.92% | $600 | $511 |

| $35 | 15.69% | $840 | $717 |

| $48 | 15.51% | $985 | $985 |

| $150 | 15.82% | $3,600 | $3,069 |

So you can see, for the first example, you pay $25 a month for 24 months. Over that time, you’ll pay $600 in loan payments and you’ll receive $511 from the CD at the end of the loan. So essentially, you’ll have paid $89 to improve your credit.

You can choose to pay off or close your account early. However, you will be charged a small early withdrawal fee on the CD. Self warns that paying off the Credit Builder Account early can decrease your credit betterment efforts.

Also, be aware that you will not have access to the CD balance until the term loan is paid in full. CD funds will be released within 10 to 14 business days of loan payoff and be delivered either by check or ACH transfer into your bank account.

How to Open a Self Credit Builder Account

To be eligible to open an account you will need to be at least 18 years old, and either a US citizen or valid permanent US resident with a physical address in the US.

You’ll also need to have the following available:

- A bank account, debit card or prepaid card (credit cards are not accepted).

- A valid email address and phone number.

- Your Social Security number.

The information is necessary to verify your identity and make payments on your account.

Credit: Self will run a “soft credit pull,” which will not affect your current credit score. However, no one is denied a Self Credit Builder Account based on their credit score. They do warn it is possible to be denied for other purposes, including lack of sufficient verification of your ID, being under age 18, not having a Social Security number, or not being either a US citizen or permanent resident.

Self also discloses that each of their bank partners will run your name through ChexSystems. This is of a repository used by banks that tracks consumer performance in managing their bank accounts. For example, if you ever closed a bank account with an open balance, it will appear in the ChexSystems database. This is another possible reason you may be denied for a Credit Builder Account. (not all banks will use ChexSystems though)

Income: Self does not require a minimum income. They only require that the monthly payment you choose be one that you can afford.

Once your account is approved, you’ll pay a one-time, non-refundable administrative fee for the service — details will be provided under Self Credit Builder Account Pricing & Fees below.

One of the three bank partners will provide you with a small loan, with the loan funds held in a certificate of deposit that’s fully FDIC insured. The following month, you’ll begin repayment on your account. The loan will be for a fixed term of 24 months.

As you make your payments on time each month, your payment history will be reported to the three major credit bureaus, allowing you to build or rebuild your credit history. Once the loan has been fully paid, the CD will mature, and the funds will be available to you. This is the strategy used by Self to both better your credit and enable you to accumulate savings in the same program.

As an added bonus, you can get your monthly credit score through Self free of charge.

Self Visa® Credit Card

Self also offers a Visa credit card. However, to be eligible for the card, you’ll need to first open a Credit Builder Account, and meet the following eligibility requirements:

- You must have made at least three monthly payments on time.

- Have at least $100 in savings progress in your Credit Builder Account.

- Your account must be in good standing.

Just as with the Credit Builder Account, your credit history — or the lack of it — will not be a factor in determining your eligibility for the card. In fact, there is no hard credit check.

If you become eligible for the Self Visa® Credit Card, you can choose what portion of your savings progress will be used to secure your card and set your credit limit. That limit must be a minimum of $100. The credit limit can be increased in increments of $25 at a time, based on the increase in your portion of the balance in your Credit Builder Account CD.

The Self Visa® Credit Card does not offer rewards or allow balance transfers or cash advances. It is also not possible to add an authorized user. However, just as is the case with the Credit Builder Account, your payment history on the Self Visa®Credit Card will also be reported to all three major credit bureaus, giving you another good credit reference.

Your Self Secured Visa® Credit Card credit line is tied to the funds on deposit in your Credit Builder Account. The only way to have those funds released at the end of the loan term is to cancel your Visa® card. Unfortunately, the portion of your Credit Builder Account CD that secures your Visa® credit card does not earn interest.

Why Not Just Apply for a Credit Card or a Personal Loan?

In theory, you could apply for either a credit card or a personal loan to help you build or rebuild your credit. But there are a couple of problems with that strategy.

First, if you don’t have a credit score, it’s almost impossible to get a credit card or personal loan. Second, if you have bad credit, you won’t be eligible for traditional credit cards or personal loans.

In either case, you’ll be forced to take a credit card or personal loan that will either charge exorbitant interest rates and/or very high annual or monthly fees. And just as important, credit cards and personal loans for consumers with no credit or bad credit are notorious for very low loan limits. Plus, in the case of credit cards, you may be required to provide a security deposit

And unlike the Self Credit Builder Account, neither a credit card nor a personal loan will leave you with money in savings after you’re done with the arrangements. That’s because Self provides a dual advantage: credit building while also building savings (minus interest and fees, of course).

Availability: All 50 US states. Self is not available outside the US.

Savings security: All funds accumulated through your monthly payments will be held in a CD at a partner bank and will be fully FDIC insured.

Referral bonus: The Self Financial dashboard will give you access to a unique referral URL. You can provide that to friends and family members and earn $10 for each person who signs up for a Credit Builder Account. The referral bonus will be paid after the friend or family member has been approved for an account and has made his or her first account payment.

Mobile App: Available at The App Store for iOS devices, 10.0 and later, and is compatible with iPhone, iPad, and iPod touch. Also available on Google Play for Android devices, 5.0 and up.

Customer support: Available by email and live chat, Monday through Friday, from 9:00 AM to 5:00 PM, Central time.

Self Credit Builder Account Pricing & Fees

Each loan has a specific interest rate and APR. Those APRs are shown under the “Four Different Self Credit Builder Account Loan Options” section above.

If you close your account before the end of the term, you may be subject to an early withdrawal fee of up to $5, depending on the account size.

Late fee: If a loan payment is more than 15 days past due, you’ll be charged a late fee equal to 5% of the scheduled monthly payment. If the payment is more than 30 days past due, it will be reported as a late payment to the three credit bureaus.

Self Credit Builder Account Pricing & Fees

Each loan has a specific interest rate and APR. Those APRs are shown under the “Four Different Self Credit Builder Account Loan Options” section above.

If you close your account before the end of the term there is an early withdrawal fee of up to $5 depending on the account size.

Late fee: If a loan payment is more than 15 days past due, you’ll be charged a late fee equal to 5% of the scheduled monthly payment. If the payment is more than 30 days past due, it will be reported as a late payment to the three credit bureaus.

Alternatives to Self Credit Builder

Self Credit Builder isn’t the only credit builder loan available. There are now several companies that offer credit builder loans, here’s how they compare:

Kikoff

When you sign up for Kikoff, you can get a $750 credit line (Kikoff Credit Account) with no credit check — but there is a $5 monthly membership fee (annual commitment). You can then make purchases from the Kikoff store.

You can also get a secured credit card. It’s a secured card that acts like a prepaid debit card. You load money onto the card, as you spend money is removed from your available balance and set aside. The payment is then made in full from the set aside funds.

Your payments to both the line of credit and the credit card are reported to all three credit bureaus.

If you want to learn more, check out our Kikoff review.

Chime

Chime has a Chime Credit Builder Secured Visa Credit Card. This card works like a prepaid debit card. Once you load the card, you can use it like any other credit card. As you spend, the purchase amounts are removed from your card and put aside to be used to pay off the card on the due date. There are no annual or monthly fees on this account.

Chime also reports to all three bureaus – Experian, Equifax, and Transunion.

Our full review of Chime has more information on this.

Learn more about Chime Credit Builder

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. Please see back of your Card for its issuing bank.

StellarFi

StellarFi lets you build credit by paying your regular bills. It works by paying your bills for you, essentially lending you the money. Then, you pay StellarFi back. They report that payment to the credit bureaus, which builds your credit.

There are three plans available, and they cost between $4.99 and $29.99 per month, depending on how much the bills are that you want paid.

Learn more at our full review of StellarFi.

Will Self Credit Builder Work for You?

If you’re not happy with your credit report and credit score, or you have no credit profile at all, the Self Credit Builder Account is a good option. What’s more, it will also allow you to begin building savings. That’s important because those with bad credit often have a lack of savings, which is part of the reason for the bad credit itself.

In that way, the Self Credit Builder Account will help you achieve two very important financial milestones in the same program. You can participate in the program with a monthly payment of as little as $25, and both fees and interest rates are very reasonable.

Think about it — you can build your credit over 24 months, and by the time you complete the program, there’ll be a funded CD waiting for you. Self has put together a best-in-class service to help consumers both better their credit. If you’re looking to do either or both, this is the program for you.

*All Credit Builder Accounts made by Lead Bank, Member FDIC, Equal Housing Lender, Sunrise Banks, N.A. Member FDIC, Equal Housing Lender or Atlantic Capital Bank, N.A. Member FDIC, Equal Housing Lender. Subject to ID Verification. Individual borrowers must be a U.S. Citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to consumer report review and approval. All Certificates of Deposit (CD) are deposited in Lead Bank, Member FDIC, Sunrise Banks, N.A., Member FDIC or Atlantic Capital Bank, N.A., Member FDIC.

**The secured Self Visa® Credit Card is issued by Lead Bank or First Century Bank, N.A., each Member FDIC. See Self.inc for details.

***Sample loans: $25/mo, 24 mos, 15.92% APR; $35/mo, 24 mos, 15.69% APR; $48/mo, 24 mos, 15.51% APR; $150/mo, 24 mos, 15.82% APR. See self.inc/pricing

****Card eligibility: Active Credit Builder Account in good standing, 3 on-time payments, $100 or more in savings progress, and satisfy income requirements. Requirements are subject to change.

*****Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., First Century Bank, N.A., each Member FDIC. Subject to credit approval.

Other Posts You May Enjoy:

SoFi® Checking & Savings Review: A Bank Account with a Cash Bonus

SoFi Money Product Name: SoFi Money Product Description: SoFi’s bank account is a checking and savings combination that earns a…

CreditFresh Review: Quick Credit Approvals – Is it Worth the Cost?

CreditFresh offers a line of credit that allows you to make on-demand withdrawals. It’s possible to qualify for a borrowing limit between $500 and $5,000 while avoiding hidden fees. This CreditFresh review covers the strengths and weaknesses of this borrowing option and whether this is the best way to borrow money.

WiserAdvisor Review: A Legit Way to Find an Advisor?

Finding a financial advisor you can trust can be challenging. Thankfully, WiserAdvisor can match you with professional advisors in their network that they have vetted in advance. The best part is that their service is free, and there’s no obligation. But is WiserAdvisor a legitimate platform? Find out in this full review.

Motley Fool Review 2024: Is Stock Advisor Worth It?

Motley Fool Stock Advisor $99 / first year Product Name: Motley Fool Stock Advisor Product Description: Motley Fool Stock Advisor…

About Kevin Mercadante

Since 2009, Kevin Mercadante has been sharing his journey from a washed-up mortgage loan officer emerging from the Financial Meltdown as a contract/self-employed “slash worker” – accountant/blogger/freelance blog writer – on OutofYourRut.com. He offers career strategies, from dealing with under-employment to transitioning into self-employment, and provides “Alt-retirement strategies” for the vast majority who won’t retire to the beach as millionaires.

He also frequently discusses the big-picture trends that are putting the squeeze on the bottom 90%, offering workarounds and expense cutting tips to help readers carve out more money to save in their budgets – a.k.a., breaking the “savings barrier” and transitioning from debtor to saver.

Kevin has a B.S. in Accounting and Finance from Montclair State University.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.